-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

How to File Utah Articles of Incorporation

Your Guide to Incorporating in Utah

Utah articles of incorporation are filed to create a corporation. This guide provides instructions and tips when preparing and filing this legal document.

Incorporate NowOverview

Preparing and filing your articles of incorporation is the first step in starting your business or nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation. Only after this approval can the corporation apply for tax IDs, obtain business licenses, sign contracts, and otherwise conduct business.

Incorporating provides many important benefits:

- Limits the liability of directors, officers, and shareholders

- Fulfills statutory requirements to register your business’s or organization’s name

- Provides governance and adds credibility to the business or organization

Incorporating in Utah is a three-step process:

- Choose a corporate name. Names must be distinguishable from the names of all other registered business entities. You should perform a business name search of Utah's corporate records. It is also a good idea to search the Internet and other relevant databases to find out if other businesses exist with the same name. You can optionally reserve your business name for 120 days by filing the Application for Reservation of Business Name. The filing fee is $22 and can be filed by mail or online.

- Submit your articles of incorporation in duplicate to the Division of Corporations. Articles can be filed by mail, fax, or online. The filing fee is $70 for profit corporations and $30 for nonprofits. Once the Division approves the articles, the corporation is active.

- The Division indexes the filing and places the corporate record on the public portion of its website.

The Utah Division of Corporations provides template articles of incorporation for profit and nonprofit corporations.

Before Filing Your Articles of Incorporation

Before you prepare to file your articles of incorporation, here are a few words of caution:

Take time to understand the specific information required on these documents. Documents prepared by

non-professionals are often rejected for a number of common reasons such as not providing required information. This

guide will help you through. When in doubt, consult the Utah Code Title 16 or contact a

professional. Changing or updating your corporations information requires filing articles of amendment, which costs

$37 for profit corporations and $17 for nonprofits.

The Utah articles of incorporation templates include the minimum amount of information you must provide for state approval. Utah refers to using these templates as "generic format" corporations. In most cases however, corporations should include additional information. Other government agencies may require provisions beyond those that are included in the "generic format" articles. The IRS, for instance, requires dissolution provisions for 501(c)(3) eligibility. State tax exemptions, licenses, certifications, and even some banks require specific provisions in the articles. This guide lists some of the common purposes requiring added provisions.

Quick Facts

What types of entities are incorporated in Utah?- Profit corporations

- Nonprofit corporations

- Professional corporations

Is an attorney required to incorporate?

No, using an attorney is not required. You can file yourself using this guide or we can help.

What does it cost to incorporate?

Division of Corporations fee: $70 for profit corporations and $30 for nonprofits

How long does the process take?

Online filings are auto expedited and take 1-2 business days. Mailed articles are processed in around 2 weeks.

Who processes articles of incorporation?

The Utah Division of Corporations

What is the Division's contact information?

Address: 160 E. 300 S. 2nd Floor

Salt Lake City, UT 84111

Phone: 801-530-4849

Toll-Free: 1-877-526-3994

Fax: 801-530-6438

What are the state corporate statutes?

Utah Code Title 16

Profit Corporations

For profit corporations and professional corporations

How to File Articles of Incorporation for a Utah Profit Corporation

Utah profit articles of incorporation must include the information listed below. Certain information is optional and is noted as such. The information provided to the Division of Corporations is considered public record. If you wish to keep certain information private, contact a professional for assistance.

1

Corporate Name

The name of your corporation must be distinguishable from all businesses names registered in Utah. This includes the

names of other corporations, nonprofits, limited liability companies, registered partnerships, trademarks, service

marks, assumed names, fictitious names, and reserved names. You may choose to reserve your corporate name for 120

days prior to filing your articles of incorporation by filing the Application for Reservation of Business Name. The

filing fee is $22 and can be filed by mail or online.

Your corporate name must contain a corporate designator such as “corporation”, “incorporated”, ”company”,

or an abbreviation of one of the same.

Certain words cannot be used in the corporate name without first obtaining approval such as words indicating

connection with the Olympics or educational institutions.

2

Purpose

List the purpose or purposes for which the corporation is organizing. A general statement that the purpose of the corporation is to engage in any lawful act is acceptable.

3

Shares

List the number and type(s) of shares authorized. Corporations may issue one class of shares (e.g., common stock) or issue more than one types of shares (e.g., common stock and preferred stock). The articles of incorporation must list the preferences, limitations, and relative rights of each class if more than one class is authorized.

4

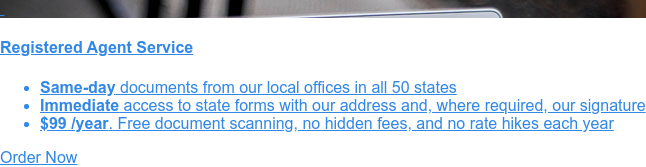

Registered Agent Name & Address

A registered agent receives service of process (notice of a lawsuit) and government notices for the corporation. The

agent can be either an individual, such as an officer of the corporation, or a business entity. A corporation cannot

serve as its own registered agent. If you wish to keep your name and address off the public portion of the state's

website, then you can appoint a commercial registered agent to be listed and serve

as your agent. Appointing a commercial registered agent is a desirable option if you have a home office, are

regularly out of the office, want the added privacy, or do not want to risk a sheriff or process server arriving at

your office in front of clients or employees.

The registered office address must be a street address located in Utah. It may not be a PO box or mailbox service.

5

Incorporators

List the name and address of the individual responsible for organizing the corporation. The incorporator must be a natural person of 18 years of age. You can attach a separate sheet to list more than one incorporator. All incorporators must sign the articles.

6

Principal Address

List the principal address of the business.

*

Professional Corporations (P.C.s only)

Professional corporations are organized for the purpose of providing professional services such as medicine, law, or public accounting. In addition to the information listed above, professional corporations must include the following provisions:

- The profession to be practiced through the corporation.

- The names and addresses of all of the initial shareholders, directors, and officers. Note: the number of shareholder members of the board of directors may be less than the number of shareholders. If a corporation has only one shareholder then the board may consist of that shareholder.

- Professional corporations may not include the word “incorporated“ or an abbreviation of the same. Instead, the corporation must include the words “Professional Corporation” or the abbreviation “P.C.” or “P C”. The names of professional corporations must also abide by any rules set forth by the applicable licensing agency.

*

Directors & Officers (Optional)

Directors are elected by the shareholders to oversee the management of the corporation. The Board of Directors elects corporate officers to run the day-to-day operations and make certain decisions for the corporation. You may list the names, position(s), and addresses of the initial directors. Utah corporations are required to have at minimum three directors. In the first year, a corporation may have one director and one officer. This information is not required to be listed in the articles.

*

More Provisions (Optional)

You may choose to include additional statements in the articles of incorporation. Remember that any information you include will become part of the public record. Any statements not included in the articles can be included in the bylaws, and vice versa. You may choose to include to provisions regarding the following:

- Reservation to the shareholders of the right to adopt the initial bylaws of the corporation.

- Managing the business and regulating the affairs of the corporation.

- Defining, limiting and regulating the powers of the corporation, its board of directors and shareholders.

- A par value for authorized shares or classes of shares.

- A provision eliminating or limiting the liability of a director to the corporation or its shareholders for money damages for any action taken, or any failure to take any action, as a director, except liability for

Supplementary Documents a Utah Profit Corporation May File with the Articles of Incorporation

Name Reservation Certificate

If you filed a name reservation, attach the certificate of name registration.

Right to Corporate Name

If your corporate name is not distinguishable from other business names, you may include documentation showing your right to use the name.

Approval to Use Name

If the corporate name requires approval by an agency, include a copy of the approval issued.

Filing Fees

Include applicable state filing fees ($70).

Other Filing Tips

State forms must be typed or laser printed.

Nonprofit Corporations

How to File Articles of Incorporation for a Nonprofit Corporation

Utah nonprofit articles of incorporation must include the information listed below. Certain information is optional and is noted as such. The information provided to the Division of Corporations is considered public record. If you wish to keep certain information private, contact a professional for assistance.

1

Corporate Name

The name of your nonprofit corporation must be distinguishable from all names registered in Utah, including the names

of other corporations, nonprofits, limited liability companies, registered partnerships, trademarks, service marks,

assumed names, fictitious names, and reserved names. You may choose to reserve your corporate name for 120 days

prior to filing your articles of incorporation by filing the Application for Reservation of Business Name. The

filing fee is $22 and can be filed by mail or online.

Your corporate name may contain a corporate designator such as “corporation”, “incorporated”, ”company”,

or an abbreviation of one of the same.

Certain words cannot be used in the corporate name without first obtaining approval such as words indicating

connection with the Olympics or educational institutions.

2

Purpose

List the purpose or purposes for which the nonprofit is organizing. A general statement that the purpose of the

corporation is to engage in any lawful act is acceptable, or you may detail a more specific purpose or

purposes.

If you will apply for 501(c)(3) federal tax exemption, the IRS will require a description of the organization's

purpose to be included in the articles. Consider using the language prescribed for your desired exemption as listed

in IRS Pub Rev-557.

3

Registered Agent Name & Address

A registered agent receives service of process (notice of a lawsuit) and government notices for the corporation. The

agent can be either an individual, such as an officer of the corporation, or a business entity. A nonprofit

corporation cannot serve as its own registered agent. If you wish to keep your name and address off the public

portion of the state's website, then you can appoint a commercial registered agent

to be listed and serve as your agent. Appointing a commercial registered agent is a desirable option if the

nonprofit is operating out of a home office of one of the directors, or if the office is not regularly open. A

nonprofit may also choose to appoint a commercial agent to avoid the risk of a sheriff or process server arriving at

the office in front of employees, partners, or donors.

The registered office address must be a street address located in Utah. It may not be a PO box or mailbox service.

4

Incorporators

List the name and address of the individual responsible for organizing the corporation. The incorporator must be a natural person of 18 years of age. You can attach a separate sheet to list more than one incorporator. All incorporators must sign the articles.

5

Voting Members

Include a statement as to whether the nonprofit will have voting members. Members of a nonprofit corporation elect the board of directors and provide a layer of oversight that is important to many nonprofits, especially larger ones. Having members however adds complexity in management, recordkeeping, and compliance.

6

Shares

Include a statement as to whether the nonprofit will issue shares evidencing membership or interests in property rights. If shares will be issued, indicate the aggregate number of shares to be authorized and whether the shares will be divided up into classes.

7

Assets

State that upon dissolution of the nonprofit corporation, assets will be distributed in a manner consistent with the law. See 'Provisions Required for 501(c)(3) Eligibility' below for dissolution provisions for 501(c)(3) organizations.

8

Principal Address

List the principal address of the nonprofit corporation.

9

Provisions Required for 501(c)(3) Eligibility

Nonprofits that wish to apply for 501(c)(3) exemption should review IRS rules and include required provisions. IRS guidance for your desired exemption is available in IRS Pub Rev-557. In general:

- Describe how the nonprofit will distribute assets if the corporation is dissolved or liquidated.

- Include provisions regarding regulating the internal affairs of the corporation such as limiting inurement.

Understand that, more generally, federal and state tax exemptions often require specific language in the articles of incorporation. It is best to research and use the exact language required by each tax-exemption or tax-deductible application in each state and with each agency where you will apply.

*

Directors & Officers (Optional)

Directors are elected to oversee the management of the nonprofit corporation. The Board of Directors elects corporate officers to run the day-to-day operations of the nonprofit. You may list the names, position(s), and addresses of the initial directors. Utah nonprofits are required to have at minimum three directors. The initial directors are not required to be listed in the articles and can be listed in the bylaws instead.

*

More Provisions (Optional)

You may choose to include additional statements in the articles of incorporation. Remember that any information you include will become part of the public record. Any statements not included in the articles can be included in the bylaws, and vice versa. You may choose to include to provisions regarding the following:

- Managing the business and regulating the affairs of the corporation.

- Defining, limiting and regulating the powers of the nonprofit corporation, its board of directors, and its members.

- If there are members, the characteristics, qualifications, rights, limitations, and obligations of each or any class of members

- Whether cumulative voting will be permitted

Supplementary Documents a Nonprofit Corporation May File with the Articles of Incorporation

Name Reservation Certificate

If you filed a name reservation, attach the certificate of name registration.

Right to Corporate Name

If your corporate name is not distinguishable from other business names, you may include documentation showing your right to use the name.

Approval to Use Name

If the corporate name requires approval by an agency, include a copy of the approval issued.

Filing Fees

Include applicable state filing fees ($30).

Other Filing Tips

State forms must be typed or laser printed.

Additional Requirements for Utah Corporations

Utah Corporation Annual Report

Utah will mail an annual report to the corporation, which must be filed within 60 of receiving the report along with a fee of $15. The report should include the following information:

- The corporate name of corporation

- Any assumed corporate name of the foreign nonprofit corporation

- The jurisdiction under whose law it is incorporated

- The current registered agent and address

- The street address of its principal office, wherever located

- The names and addresses of its directors and principal officers.

Next Steps

Filing articles of incorporation is the first step in setting up a corporation. When this document is approved, next you will register for taxes and establish records. Our all-in-one incorporation packages help you get set up in one step.

- Obtain a Federal Tax ID (EIN), a unique nine-digit number assigned by the IRS to identify your business.

- Many small businesses creating a profit corporation choose to elect to be taxed as an

S-Corporation. You must file form IRS-2553 within 75 calendar days of incorporation.

- Electing Subchapter S status helps shareholders avoid the double taxation that applies to traditional C-Corporations.

- S-Corps can also help the owners avoid paying the 15.3% Self-Employment Tax (Social Security and Medicare) on shareholder distributions.

- Nonprofit corporations often wish to obtain federal income tax exemption under 501(c)(3). 501(c)(3) recognition also allows donors to make tax deductible contributions.

- Register for state taxes. State tax registration requirements vary, but the most common registrations are for sales tax and employer taxes. Nonprofits can often apply for income and sales tax exemptions. Remember to consider each state in which your business or organization will operate.

- Nonprofits often need to register in each state before fundraising. Be sure to check the procedures for obtaining the authority to solicit, employee solicitors, or otherwise engage in fundraising in each state where you raise funds.

- Apply for licenses and/or permits. Federal, state, and local licenses or permits may be required.

- Hold an organizational meeting of the incorporators and take minutes of that meeting. At that time, you will ratify corporate bylaws, adopt a shareholders agreement, issue stock certificates and complete a stock ledger, elect directors and officers, and take other such corporate actions. Consider purchasing our corporate kit that stores your documents and contains your corporate seal and stock certificates.

- Maintaining the corporation requires following ongoing requirements such as conducting annual meetings, electing directors and officers, maintaining a registered agent and office, amending the bylaws or articles of incorporation as needed, and more. For more information on business compliance action items, please consult your Harbor Compliance representative.