-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

How to File Georgia Articles of Incorporation

Your Guide to Incorporating in Georgia

Georgia articles of incorporation are filed to create a corporation. This guide provides instructions and tips when preparing and filing this legal document.

Incorporate NowOverview

Preparing and filing your articles of incorporation is the first step in starting your business or nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation. Only after this approval can the corporation apply for tax IDs, obtain business licenses, sign contracts, and otherwise conduct business.

Incorporating provides many important benefits:

- Limits the liability of directors, officers, and shareholders

- Fulfills statutory requirements to register your business’s or organization’s name

- Provides governance and adds credibility to the business or organization

As you get ready to file your articles of incorporation, it is important that you take time to understand the specific information required on those documents. The state of Georgia will approve your articles of incorporation if certain minimum information is specified, but approval does not indicate that other provisions that should be included are present. Failure to file these documents correctly can delay starting your business or cause unexpected problems down the road. This guide walks you through preparing and filing your Georgia articles of incorporation so you can get your business or nonprofit corporation off to the right start.

How to IncorporateThe Georgia Department of State offers articles of incorporation templates and instructions. Be sure to locate the

correct forms for your profit or nonprofit corporation. Georgia offers both paper and online filing.

Understand that the Georgia Department of State will approve your articles of incorporation if they contain the

minimum amount of information required by Georgia statute. Acceptance does not guarantee that your corporate name

does not conflict with other trade names (trademark infringement), that your articles of incorporation contain

sufficient language to apply for 501(c)(3), or that your articles of incorporation do not contain other omissions or

errors. You may not learn about errors in your articles of incorporation until the IRS, a licensing board, bank, or

other agency refuses to accept them. Take the time to learn about filing articles of incorporation before filing

them. It is a lot easier to incorporate correctly the first time than try to fix mistakes later on.

You do not need an attorney to file your articles of incorporation. You can file the articles of incorporation

yourself or consider our incorporation packages.

Quick Facts about Incorporating

Who should incorporate?- Profit corporations

- Nonprofit corporations

- Professional corporations

Is an attorney required?

No, using an attorney is not required. You can file yourself or we can help.

What does it cost to incorporate?

The Georgia state filing fee is $100. Georgia expedited processing options are $100 next day service and $250 same day service.

How long does the process take?

Your filing will be reviewed within 5 - 15 business days, depending on the state’s workload, unless the expedited option has been selected. You will get an approval certificate or rejection letter.

Business Corporations

How to File Articles of Incorporation for a Georgia Business Corporation

Articles of incorporation for a profit corporation include the information listed below. Please note that certain information is noted as optional.

1

Name

Declare your corporate name or provide a valid name reservation number. Corporate names must be distinguishable from

all other Georgia registered entities (including LLCs, LPs, and other corporations). Search that your desired

corporate name is available prior to filing your articles of incorporation. Be sure to include a corporate

designator as a suffix to your business name. Corporate designators include corporation, incorporated, or a similar

abbreviation.

Georgia offers 30-day name reservation service for $25, which is relatively inexpensive compared to other states.

Allow 24 hours from making your name reservation to receive the name reservation number, then place it on

Transmittal Form 227 and file it with your articles of incorporation.

2

Stock

Indicate the number of shares authorized to be issued. Stock is the means by which ownership of the corporation is divided and assigned.

- You do not have to issue all shares authorized, that way you have the flexibility to add more shareholders at a later date. In the example of a corporation with three owners, you may authorize 1,000 shares and issue 250 shares to each owner. This leaves 250 shares to issue to future investors or partners.

- The articles of incorporation can be amended to increase the maximum number of shares.

- Articles that state “zero” in the number of shares will be rejected.

3

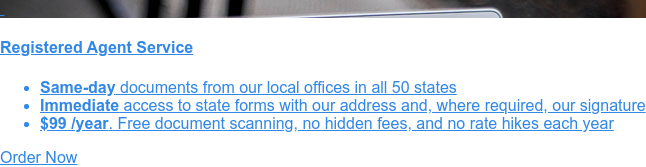

Registered agent

You are required to choose and declare your registered agent on your articles of incorporation. A registered agent is the individual or company that will receive service of process (notice of a lawsuit) and other official legal or government documents for the business.

- Name the registered office, which is the street address and county where the registered agent is located. You must list a street address located in Georgia. You may not list a P.O. box. Similarly, a mail drop or mail center may not be used.

- Name the registered agent, which is the individual, corporation, or other legal entity located at the registered office designated to accept notices on its behalf and alert corporate personnel.

- Many corporations use their attorney or a professional corporate service company for this service. If you have a home office, are regularly out of the office, or wish to have added privacy of keeping your address off the public record, then using a registered agent service may be in your interest.

- If you later need to change your registered agent, the Georgia change fee is $50.

4

Incorporator(s)

The incorporator is the individual responsible for executing the articles of incorporation. In this capacity, the incorporator signs the articles of incorporation, delivers them to the Secretary of State for filing, and then organizes the corporation. You may have a filing attorney, Chairman of the Board of Directors, or corporate officer act as incorporator or declare an other adult incorporator. You may also declare more than one incorporator. An incorporator must sign, date, state the capacity in which he or she is signing, and provide their address.

5

Principal Business Address

List the corporation’s principal mailing address, which may be a physical address or P.O. Box. Correspondence from the Corporations Division to the corporation will be sent to this address, with the exception of official documents sent to the registered agent.

6

Other Provisions

You may choose to include statements that provide more information about your company. Be aware that any information you include will become part of public record.

- You may request a specific effective date for the incorporation. By default, the incorporation will become effective the date the document is received by the Georgia Department of State.

- You may choose to include statements that provide more information about your company such as the corporate purpose(s).

- Some people prefer to include more information about the initial directors and officers. Directors are the individuals elected by the shareholders to oversee the management of the corporation. The Board of Directors elects corporate officers to run the day-to-day operations and make certain decisions for the corporation.

- If you anticipate applying for a bank loan or have other complex banking needs, contact your bank to see if they require certain information on the articles of incorporation.

7

Special corporate structures

There are special types of corporations available. Review the Official Code of Georgia Annotated (O.C.G.A.) for the options available and to learn how to be compliant with declaring a subtype. Common examples:

- A professional corporation is formed to provide a specific professional service that requires a license, such as medicine or law. Professional corporations must abide by certain conventions in their corporate name.

- A benefit corporation (B-Corporation) is a new type of corporation. B-corporations are certified to meet rigorous standards of social and environmental performance, accountability, and transparency. Georgia articles of incorporation must contain specific language for this recognition.

Supplementary Information Filed with the Articles of Incorporation

Filing of Articles of Incorporation and Data Transmittal Form 227

Your assembled articles of incorporation submission should include:

- Transmittal Form 227, which acts as a cover sheet for your submission packet and which should include a valid email address.

- The original signed articles of incorporation on white 8.5"x11" paper.

- A copy of the signed articles of incorporation on white 8.5"x11" paper.

- Filing and expedite fees made payable to the George Secretary of State.

Necessary government approvals

It may be necessary for you to obtain approvals from other government agencies, such as licensing board if you wish to use a word or words that are regulated (e.g. engineering).

Consent to appropriation of name

Your corporation may need to obtain consent to use the business name from another business entity.

How to Elect S-Corporation Status

S-Corporation is a tax election made with the US Internal Revenue Service. By default, your corporation will receive tax treatment as a C-Corporation. Many small businesses elect S-Corporation tax treatment.

- Electing Subchapter S status helps shareholders avoid the double taxation that applies to traditional C-Corporations.

- S-Corps can also help the owners avoid paying the 15.3% Self-Employment Tax (Social Security and Medicare) on distributions.

Corporations must file form IRS-2553 within 75 calendar days of incorporation to be taxed as an S-Corp.

Nonprofit Corporations

How to File Articles of Incorporation for a Georgia Nonprofit Corporation

To incorporate, your Georgia nonprofit should file nonprofit articles of incorporation. Georgia nonprofit articles of incorporation include the information listed below. Please note that certain information is noted as optional.

1

Name

Declare your corporate name or provide a valid name reservation number. Corporate names must be distinguishable from

all other Georgia registered entities (including LLCs, LPs, and other corporations). Search that your desired

corporate name is available prior to filing your articles of incorporation. Be sure to include a corporate

designator as a suffix to your business name. Corporate designators include corporation, incorporated, or a similar

abbreviation.

Georgia offers 30-day name reservation service for $25, which is relatively inexpensive compared to other states.

Allow 24 hours from making your name reservation to receive the name reservation number, then place it on

Transmittal Form 227 and file it with your articles of incorporation.

2

Organized under

Your nonprofit articles of incorporation should simply state “The corporation is organized pursuant to the Georgia Nonprofit Corporation Code.” In doing so, you are also indicating that your Georgia nonprofit corporations does not issue stock to document ownership.

3

Members or nonmembers

A nonprofit may choose whether or not to have members. Members of a nonstock corporation are like shareholders in a stock corporation. Members elect the board of directors and provide a layer of oversight that is important to many nonprofits, especially larger ones. Having members comes with added complexity in management, recordkeeping, and maintenance. You should indicate whether or not your nonprofit has members.

4

Registered agent

You are required to choose and declare your registered agent on your articles of incorporation. A registered agent is the individual or company that will receive service of process (notice of a lawsuit) and other official legal or government documents for the business.

- Name the registered office, which is the street address and county where the registered agent is located. You must list a street address located in Georgia. You may not list a P.O. box. Similarly, a mail drop or mail center may not be used.

- Name the registered agent, which is the individual, corporation, or other legal entity located at the registered office designated to accept notices on its behalf and alert corporate personnel.

- Many corporations use their attorney or a professional corporate service company for this purpose. If you have a home office, are regularly out of the office, or wish to have added privacy of keeping your address off the public record, then using a registered agent service may be in your interest.

- If you later need to change your registered agent, the Georgia change fee is $50.

5

Incorporator(s)

The incorporator is the individual responsible for executing the articles of incorporation. In this capacity, the incorporator signs the articles of incorporation, delivers them to the Secretary of State for filing, and then organizes the corporation. You may have a filing attorney, Chairman of the Board of Directors, or corporate officer act as incorporator or declare an other adult incorporator. You may also declare more than one incorporator. An incorporator must sign, date, state the capacity in which he or she is signing, and provide their address.

6

Principal Business Address

List the corporation’s principal mailing address, which may be a physical address or P.O. Box. Correspondence from the Corporations Division to the corporation will be sent to this address, with the exception of official documents sent to the registered agent.

7

Provisions to Qualify for 501(c)(3)

Many nonprofits wish to apply for federal income tax exemption for the corporation under IRC §501(c)(3) or other subsection. The IRS requires specific language in the articles of incorporation for your tax-exempt application. These statements are to the effect of the following:

- The corporation is not for profit

- It will not engage in prohibited political or legislative activity listed in 501(c)(3)

- If dissolved, it will distribute its assets in compliance with 501(c)(3)

It is wisest to check with the IRS for the exact language required for your type of nonprofit and intended tax exemption.

8

Other Provisions

You may choose to include statements that provide more information about your company. Be aware that any information you include will become part of public record.

- You may request a specific effective date for the incorporation. By default, the incorporation will become effective the date the document is received by the Georgia Department of State.

- You may choose to include statements that provide more information about your company such as the corporate purpose(s).

- You may choose to expound on the common bond of membership (if your nonprofit has members) and any restrictions to qualify for membership.

- Some people prefer to include more information about the initial directors and officers. Directors are the individuals elected by the shareholders to oversee the management of the corporation. The Board of Directors elects corporate officers to run the day-to-day operations and make certain decisions for the corporation.

- Certain banking purposes require certain information on the articles of incorporation. If you anticipate any significant banking activities such as obtaining a loan or other financing, check with your bank about their requirements. For example, listing the officers (president, vice president, secretary, and treasurer) may be required.

- Applying for certain business licenses, tax statuses, or other government classifications sometimes requires other provisions listed on your articles of incorporation. In particular, nonprofits can qualify in many states for exemption from sales tax and income tax and should provide any required language in the articles of incorporation. If your nonprofit will have a footprint in more than one state, check with each state’s department of revenue and/or division of charitable organizations.

9

Special corporate structures

There are special types of corporations available. Review the Official Code of Georgia Annotated (O.C.G.A.) for the options available and to learn how to be compliant with declaring a subtype. Common examples:

- Consider if professional or other special types of corporations apply to your situation. For example, the nonprofit “Doctors Without Borders” is an example of a professional nonprofit corporation formed to provide a specific professional service. Consider if licensed individuals will be part of your corporation, such as medicine, law, accounting, or other professions.

Supplementary Information Filed with the Articles of Incorporation

Filing of Articles of Incorporation and Data Transmittal Form 227

Your assembled articles of incorporation submission should include:

- Transmittal Form 227, which acts as a cover sheet for your submission packet. It should include a valid email address.

- The original signed articles of incorporation on white 8.5"x11" paper.

- A copy of the signed articles of incorporation on white 8.5"x11" paper.

- Filing and expedite fees made payable to the George Secretary of State.

Necessary government approvals

It may be necessary for you to obtain approvals from other government agencies, such as licensing board if you wish to use a word or words that are regulated (e.g. engineering).

Consent to appropriation of name

Your corporation may need to obtain consent to use the business name from another business entity.

Special corporate structure

Consider if you want to elect to be a nonprofit corporate subtype, such as a cooperative corporation. Check the Official Code of Georgia Annotated (O.C.G.A.) for available options and supplementary forms or language required.

How to Register for 501(c)(3), Fundraising, and State Tax Exemption

501(c)(3) Federal income tax exemption

Nonprofits may choose to apply for federal income tax exemption. 501(c)(3) recognition also allows donors to make tax deductible contributions The IRS published rev-557, an informational resource on how to obtain tax exempt status for a nonprofit organization. 501(c)(3) is perhaps the most common and well-known tax exemption category for charitable organizations, however the internal revenue code has exemption categories for many other types of nonprofits organizations. Incorporating the nonprofit and obtaining a Federal Tax ID (EIN) are precursors to applying for 501(c)(3) recognition.

State tax exemptions

501(c)(3) recognition provides income tax exemption on federal taxes. Nonprofits can apply to become exempt from paying various state taxes in each state where they conduct activities.

State fundraising registration

Some aspects of fundraising are regulated by state government. Nonprofits that solicit funds may need to submit registrations with the Department of State or Revenue in each state where they solicit residents. Contact the Georgia Office of Secretary of State Charitable Organizations section before soliciting or accepting contributions (either monetary or in-kind donations). Be sure to check the procedures for obtaining the authority to solicit, employee solicitors, or otherwise engage in fundraising in each state where you raise funds.

Additional Requirements for All Corporations

Understanding the Publishing Requirement for Articles of Incorporation

In Georgia, for-profit and nonprofit corporations are required to publish notice of their intent to incorporate no later than the next business day after filing articles of incorporation. This notice should be published in the county where the registered office is located. It should be published in the newspaper or other publication which the Clerk of the Superior Court advises is the official legal organ for that county. Specific text should be included in the publication to be compliant and legal affidavits should be obtained from the publication for the corporation’s records.

Initial Annual Registration

All Georgia corporations are required to submit an initial annual registration form within 90 days of incorporation. This form lists the three principal officers, costs $50, and should be filed with the Georgia Secretary of State. Corporations that form between October 2 and December 31 file the initial form between January 1 and April 1 of the ensuing year. Failing to file the initial or annual registration puts the corporation at risk of administrative dissolution and a $250 fee to reinstate the dissolved corporation.

Certificate of Incorporation

Your certificate of incororation, sometimes called a corporate charter, is issued upon approval of your articles of incorporation. The Georgia Secretary of State will automatically mail this back to you if your incorporation is approved. File this document in your corporate record book.

Expedited Processing of Articles of Incorporation

Standard Georgia state processing time is approximately 5-15 business days. Expedited service requests should be included with the articles of incorporation package if desired. Options are $100 for next day service (received by noon) and $250 for next day service.

Register for Federal Taxes, State Taxes, & Licenses/Permits

After successfully filing your articles of incorporation, you will apply for a Federal Tax ID (EIN), a unique nine-digit number assigned by the IRS to identify your business. You should consult your tax professional to determine your state tax registration requirements. Many businesses register for sales tax or employer taxes. You may also need to get local licenses or permits.

Hold an Organization Meeting & Establish Records

Once the registration process is complete, you should hold an organizational meeting of the incorporators and take minutes of that meeting. At that time, you will ratify corporate bylaws, adopt a shareholders agreement, issue stock certificates and complete a stock ledger, elect directors and officers, and anything else you may want to include.

Georgia Annual Report

All Georgia corporations must file an annual report with the Georgia Secretary of State. The report will update your officers, registered agent, and address information. Failure to file forfeits your right to conduct business in Georgia and can result in administrative dissolution, default judgment, and fines. The annual report is due April 1st each year. In addition, changes to officers, registered agent, and addresses should be provided to the Georgia Secretary of State with additional annual registration submissions even outside of the filing window.

Ongoing Compliance Requirements

Ongoing requirements include annual meetings with minutes, special meetings to make important business decisions, maintaining a registered office, amending your articles of incorporation as needed, and more. For more information on business compliance action items, please consult your Harbor Compliance representative.